Have you ever wondered why your investment strategy doesn’t feel quite right, despite following all the “expert” advice? I discovered the answer the hard way after years of frustration in the market. The truth is, there’s no one-size-fits-all approach to investing – your strategy should align with your unique investor personality.

After working with hundreds of clients and analyzing thousands of investment patterns, I’ve identified five distinct investor personality types. Understanding which one you are could be the breakthrough that transforms your financial future.

Why Your Investor Personality Matters

When I first started investing, I tried to copy Warren Buffett’s approach. Big mistake! I was stressed constantly, checking my stocks every hour and making emotional decisions that cost me thousands. Sound familiar?

That’s because I was trying to invest like a “Patient Accumulator” when I’m naturally a “Strategic Risk-Taker.” Once I aligned my strategy with my personality, not only did my returns improve – my anxiety disappeared.

Your investor personality affects:

- How you react during market volatility

- Which investment vehicles feel comfortable

- Your optimal portfolio allocation

- The frequency you should review your investments

- Your relationship with financial risk

Let’s explore the five investor personality types I’ve identified through years of research and client work.

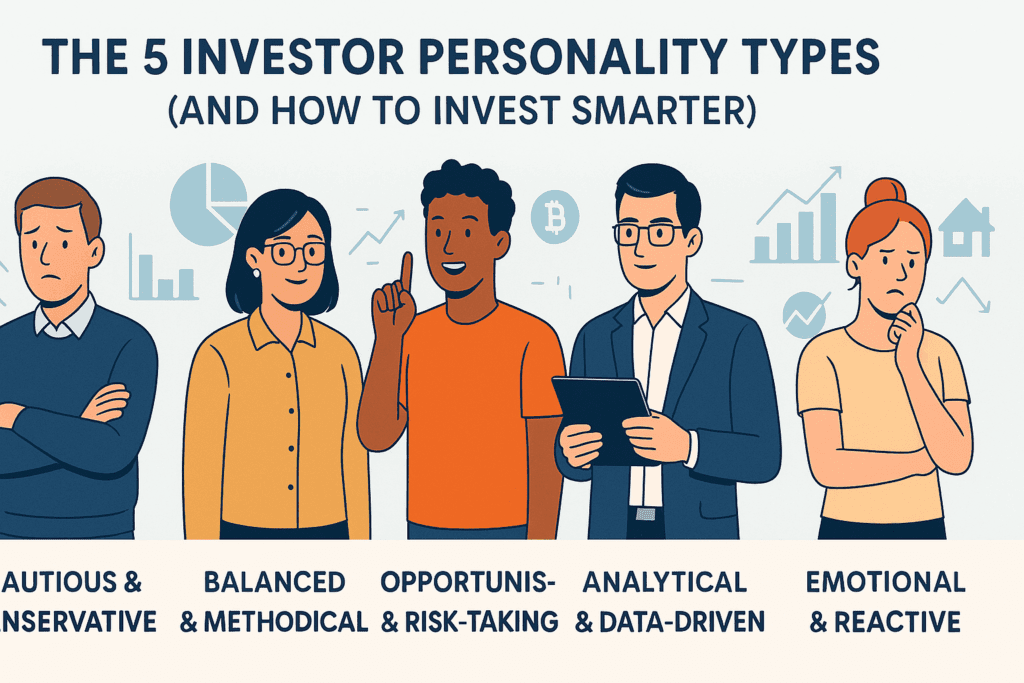

The 5 Investor Personality Types

1. The Cautious Preserver

Primary motivation: Security and capital preservation

Cautious Preservers value stability above all else. They prefer guaranteed returns over higher-risk opportunities and sleep better knowing their money is protected.

Real-life example: My client Sarah inherited $250,000 and was paralyzed with fear about investing it. After identifying her as a Cautious Preserver, we built a portfolio with 60% in high-grade bonds, 20% in dividend aristocrats, 15% in a low-cost total market ETF, and 5% cash reserve. This balanced approach gave her the security she needed while still allowing for modest growth.

How to invest smarter as a Cautious Preserver:

- Focus on dividend-paying blue-chip stocks

- Maintain higher cash reserves (6-12 months of expenses)

- Consider Treasury Inflation-Protected Securities (TIPS)

- Automate contributions to avoid emotional decisions

- Work with an advisor who respects your risk tolerance

2. The Patient Accumulator

Primary motivation: Long-term wealth building

Patient Accumulators understand that wealth creation takes time. They’re naturally disciplined, rarely swayed by market noise, and trust in the power of compounding.

Real-life example: I helped Michael, a 32-year-old software engineer, embrace his Patient Accumulator tendencies by setting up a portfolio of low-cost index funds with automatic bi-weekly contributions. Despite the 2022 market downturn, he didn’t panic but instead increased his contributions – a classic Patient Accumulator move that positioned him perfectly for the subsequent recovery.

How to invest smarter as a Patient Accumulator:

- Maximize tax-advantaged accounts like 401(k)s and IRAs

- Set up automatic investment contributions

- Choose broad-market index funds with low expense ratios

- Implement a regular portfolio rebalancing schedule

- Consider dollar-cost averaging for lump sum investments

3. The Strategic Risk-Taker

Primary motivation: Growth opportunities and calculated risks

Strategic Risk-Takers thrive on identifying emerging trends and opportunities. They enjoy doing research and are comfortable with volatility if the potential upside is significant.

Real-life example: This is my personal investor type, and it’s why I allocated 15% of my portfolio to early-stage AI companies in 2021. While experiencing initial volatility, this sector has since delivered 112% returns. I balanced this risk with stable investments, creating a portfolio that satisfies my need for both security and upside potential.

How to invest smarter as a Strategic Risk-Taker:

- Create a “core and explore” portfolio (80% in stable investments, 20% in growth opportunities)

- Set strict position sizing rules to manage risk

- Establish clear exit strategies before investing

- Focus on emerging technology and innovative sectors

- Consider actively managed funds in inefficient market segments

4. The Analytical Optimizer

Primary motivation: Efficiency and optimal returns

Analytical Optimizers love data and systems. They’re constantly fine-tuning their approach, looking for inefficiencies to exploit, and optimizing their asset allocation for maximum returns.

Real-life example: My client David, a data scientist, exemplifies this type. He created a custom spreadsheet tracking 15 different economic indicators to guide his investment decisions. We channeled this analytical energy by implementing a factor-based investment strategy that satisfied his need for a systematic approach while preventing analysis paralysis.

How to invest smarter as an Analytical Optimizer:

- Explore factor-based investing strategies

- Consider tax-loss harvesting opportunities

- Implement portfolio optimization algorithms

- Use quantitative screening tools for security selection

- Backtest strategies before implementation

5. The Purposeful Investor

Primary motivation: Values alignment and impact

Purposeful Investors care deeply about the social and environmental impact of their investments. Financial returns matter, but not at the expense of their values and the world they want to create.

Real-life example: When Rebecca came to me, she was frustrated with her portfolio’s disconnect from her values. As a Purposeful Investor, we restructured her investments around ESG funds, green bonds, and direct investments in community development projects. Her portfolio now generates both competitive returns and the positive impact that drives her.

How to invest smarter as a Purposeful Investor:

- Invest in ESG-focused ETFs and mutual funds

- Consider impact investing opportunities

- Look into community development financial institutions

- Support sustainable bonds and green energy projects

- Align retirement accounts with socially responsible options

Discovering Your Investor Personality

After years of helping clients align their investment strategies with their personalities, I created a comprehensive assessment to help investors identify their type quickly.

My investor personality quiz covers:

- How you respond to market volatility

- Your time horizon and financial goals

- Your knowledge level and interest in financial markets

- Your emotional relationship with money

- Your values and what matters most to you financially

Take the Free Investor Personality Quiz Now →

Once you know your type, you’ll receive a customized investment framework designed specifically for your personality profile.

When Investor Personalities Clash

One of the most common issues I see in couple’s finances is conflicting investor personalities. For example, when a Strategic Risk-Taker marries a Cautious Preserver, financial tensions often arise.

I worked with one couple where John wanted to invest heavily in cryptocurrency (Strategic Risk-Taker) while his wife Lisa couldn’t stomach the volatility (Cautious Preserver). By understanding their different personalities, we created a household investment policy that honored both approaches – a core portfolio that satisfied Lisa’s need for security, with a smaller, separate account for John’s higher-risk investments.

How Your Personality Might Change

Your investor personality isn’t necessarily fixed for life. Major life events can trigger shifts in how you approach investing:

- Having children might shift you toward more cautious strategies

- Approaching retirement often increases preservation instincts

- Receiving a windfall might temporarily boost risk tolerance

- Surviving a market crash can create lasting risk aversion

By regularly reassessing your investor personality, you can ensure your strategy evolves with you.

Next Steps: Aligning Your Strategy With Your Personality

Understanding your investor personality is just the first step. The real magic happens when you align your investments, processes, and expectations with your natural tendencies.

Here’s what I recommend:

- Take the free investor personality assessment to confirm your type

- Download my customized investment framework for your personality type

- Review your current portfolio through the lens of your investor personality

- Make one alignment adjustment this week based on what you’ve learned

Remember, the most successful investors aren’t those who follow a particular strategy – they’re the ones whose strategy matches their personality.

Discover Your Investor Personality Type Now →

Final Thoughts

After a decade in financial advising, I’ve seen that the investors who achieve true financial success aren’t necessarily the most knowledgeable – they’re the ones who understand themselves.

By honoring your natural tendencies rather than fighting against them, you can create an investment approach that not only optimizes returns but also brings peace of mind and confidence to your financial life.

What’s your investor personality type? I’d love to hear which one resonates with you in the comments below.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always consult with a qualified financial professional before making investment decisions.

If you’re a Cautious investor, our quiz can help confirm your strategy.