Have you ever wondered how wealthy investors manage to grow their money consistently while minimizing risk? The secret lies in creating a balanced investment portfolio that can weather market volatility while generating steady returns. With 65% of Americans investing in the stock market but many lacking proper diversification, understanding how to balance your investments has never been more critical for financial security.

This comprehensive guide will walk you through the essential steps to build and maintain a balanced investment portfolio that aligns with your financial goals, risk tolerance, and time horizon.

What Is a Balanced Investment Portfolio?

A balanced investment portfolio is a strategic mix of different asset classes designed to achieve optimal returns while managing risk through diversification. Unlike putting all your money into a single investment type, a balanced approach spreads your capital across various assets that respond differently to market conditions.

Key Components of Portfolio Balance

- Asset allocation: The strategic distribution of investments across different asset classes

- Diversification: Spreading investments within each asset class to reduce specific risks

- Risk management: Aligning investment choices with your personal risk tolerance

- Time horizon planning: Structuring investments according to when you’ll need the money

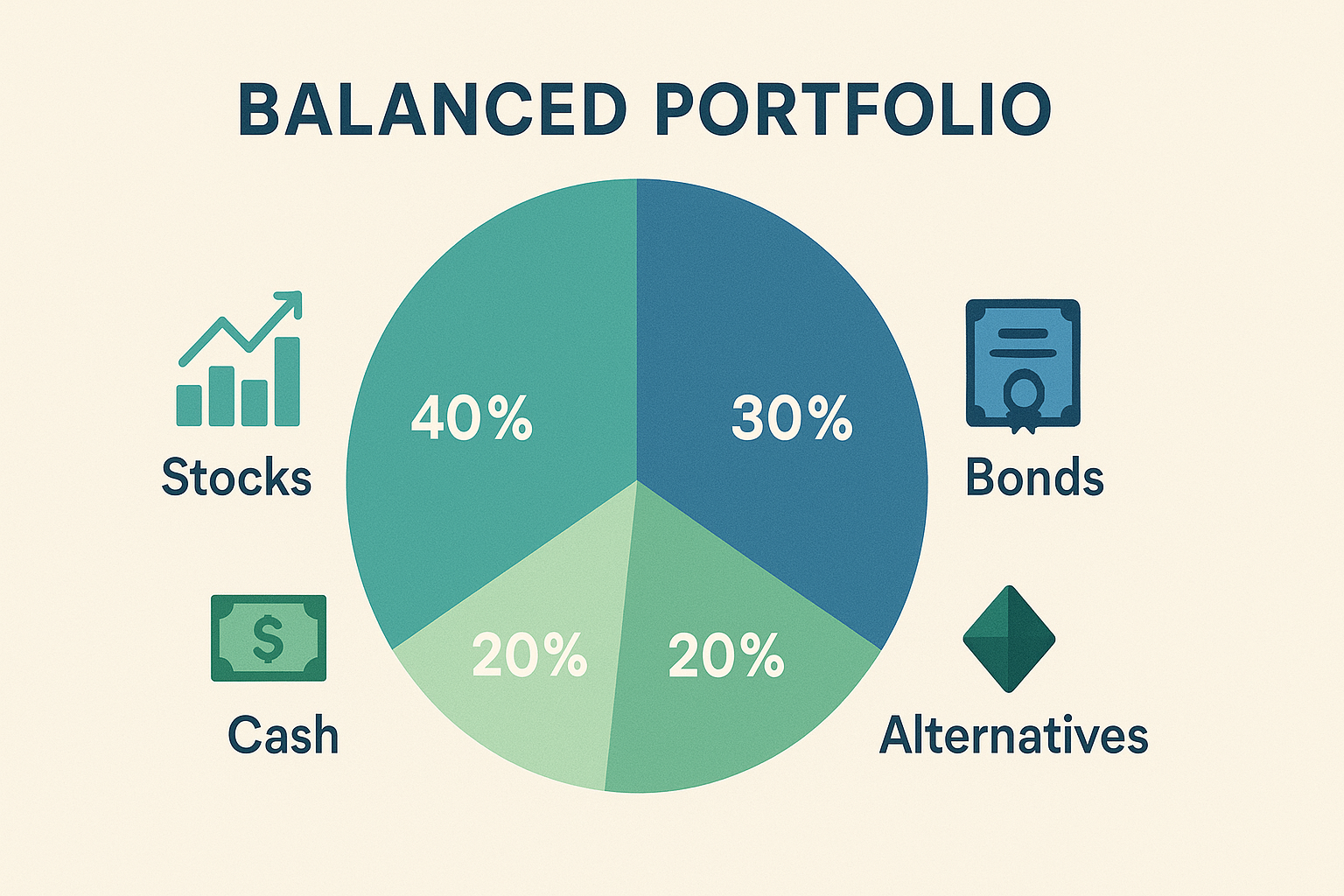

A balanced investment portfolio typically includes a mix of stocks (for growth), bonds (for stability), and cash equivalents (for liquidity), with allocations varying based on individual risk tolerance, financial goals, and investment timeline. Most financial advisors recommend reassessing and rebalancing this mix annually or after significant market shifts.

Why Portfolio Diversification Matters

Diversification is the cornerstone of any sound investment strategy. By spreading investments across various asset classes, you create a safety net that can protect your wealth during market downturns while capitalizing on growth opportunities.

According to a 2024 study by Vanguard, properly diversified portfolios experienced 33% less volatility than concentrated portfolios over a 20-year period while achieving comparable returns.

Benefits of a Properly Diversified Portfolio:

- Reduced overall risk: When one asset class underperforms, others may outperform

- Protection against market volatility: Smoother investment experience with fewer dramatic swings

- Consistent long-term performance: More reliable progress toward financial goals

- Better risk-adjusted returns: Potentially higher returns for the level of risk taken

Essential Asset Classes for a Balanced Portfolio

1. Stocks (Equities)

Stocks represent ownership in companies and typically offer the highest potential returns among traditional investments. They’re essential for long-term growth but come with higher volatility.

Types of stocks to consider:

- Large-cap (established companies like Apple or Microsoft)

- Mid-cap (growing companies with proven business models)

- Small-cap (smaller companies with high growth potential)

- International stocks (exposure to global markets)

The historical average annual return for stocks is approximately 10% before inflation, making them crucial for wealth building and outpacing inflation.

2. Bonds (Fixed Income)

Bonds are debt securities that provide regular income and act as a stabilizing force in your portfolio. They typically offer lower returns than stocks but with significantly less volatility.

Types of bonds to include:

- Government bonds (treasuries)

- Municipal bonds (tax advantages)

- Corporate bonds (higher yields with more risk)

- International bonds (global diversification)

Most financial advisors recommend that your bond allocation percentage should roughly equal your age, though this is just a starting point for consideration.

3. Cash and Cash Equivalents

Maintaining a portion of your portfolio in highly liquid assets ensures you have funds available for emergencies or opportunistic investments without selling other positions.

Examples include:

- Money market funds

- Certificates of deposit (CDs)

- Treasury bills

- High-yield savings accounts

Financial experts typically recommend keeping 3-6 months of living expenses in cash reserves before expanding other investments.

4. Alternative Investments

Beyond traditional assets, alternative investments can provide additional diversification benefits and potentially higher returns, though often with less liquidity.

Popular alternative investments:

- Real estate (REITs, rental properties)

- Commodities (gold, silver, agricultural products)

- Private equity

- Cryptocurrency (limited allocation for most investors)

How to Determine Your Ideal Asset Allocation

Creating the right mix of investments depends on three primary factors: your financial goals, risk tolerance, and investment timeline.

Assessing Your Risk Tolerance

Your comfort with investment volatility should significantly influence your asset allocation. To determine your risk tolerance:

- Consider how you would react to a 20% market decline

- Evaluate your financial capacity to absorb losses

- Assess your time horizon (longer horizons can tolerate more risk)

- Reflect on past behavior during market downturns

Risk tolerance questionnaires, available through many financial institutions, can provide structured guidance.

The Role of Time Horizon

Short-term goals (0-3 years)

- Higher allocation to cash and short-term bonds

- Minimal exposure to stocks

- Focus on capital preservation

Medium-term goals (3-10 years)

- Moderate mix of stocks and bonds

- Some cash holdings

- Balance between growth and stability

Long-term goals (10+ years)

- Higher allocation to stocks

- Lower percentage in bonds

- Minimal cash beyond emergency reserves

- Greater capacity to weather market volatility

Sample Investment Portfolio Models

Conservative Portfolio (Lower Risk)

- 30% stocks

- 50% bonds

- 15% cash equivalents

- 5% alternative investments

Best for: Near-retirees or those with low risk tolerance

Moderate Portfolio (Balanced Risk)

- 50% stocks

- 35% bonds

- 10% cash equivalents

- 5% alternative investments

Best for: Mid-career investors with moderate risk tolerance

Aggressive Portfolio (Higher Risk)

- 75% stocks

- 15% bonds

- 5% cash equivalents

- 5% alternative investments

Best for: Young investors with long time horizons and high risk tolerance

If you’re a Cautious investor, our quiz can help confirm your strategy.

How to Build Your Balanced Portfolio: Step-by-Step

1. Define Your Investment Goals

Start by clearly articulating what you’re investing for:

- Retirement

- Home purchase

- College education

- Building wealth

- Income generation

Each goal may require a different investment approach and time horizon.

2. Assess Your Risk Tolerance

Be honest about your emotional and financial capacity to handle investment volatility. Consider using professional risk assessment tools or working with a financial advisor.

3. Create Your Target Asset Allocation

Based on your goals and risk tolerance, determine what percentage of your portfolio should be allocated to each asset class. The examples above provide starting points.

4. Select Specific Investments

Choose quality investment vehicles for each asset class:

- Stocks: Individual shares, ETFs, mutual funds, index funds

- Bonds: Treasury bonds, corporate bond funds, municipal bonds

- Cash: High-yield savings, money market funds, CDs

- Alternatives: REITs, commodity ETFs, precious metals

For most investors, low-cost index funds and ETFs offer the most efficient way to gain diversified exposure to various asset classes.

5. Implement Your Plan

Once you’ve designed your balanced portfolio, it’s time to execute:

- Consider dollar-cost averaging (investing gradually over time)

- Minimize transaction costs and taxes

- Utilize tax-advantaged accounts when possible (401(k), IRA, HSA)

6. Monitor and Rebalance Regularly

A balanced portfolio requires periodic maintenance:

- Review performance quarterly

- Rebalance annually or when allocations drift significantly (typically 5% or more)

- Adjust allocations as your time horizon shortens or goals change

Common Portfolio Balancing Mistakes to Avoid

1. Emotional Decision-Making

Market volatility often triggers fear or greed, leading to poor timing decisions. Maintain discipline and stick to your long-term strategy.

2. Insufficient Diversification

Many investors believe they’re diversified when they own multiple stocks or funds, but true diversification requires spreading investments across uncorrelated asset classes.

3. Neglecting Portfolio Rebalancing

Failing to rebalance regularly allows your asset allocation to drift, potentially increasing risk beyond your comfort level or reducing growth potential.

4. Ignoring Fees and Expenses

High investment fees can significantly erode returns over time. Prioritize low-cost investment vehicles when building your portfolio.

5. Forgetting About Inflation

A balanced portfolio must account for inflation’s impact on purchasing power. Include growth-oriented investments to maintain real returns.

Advanced Strategies for Portfolio Optimization

Tax-Efficient Investment Placement

Strategic placement of investments across taxable and tax-advantaged accounts can enhance after-tax returns:

- Hold tax-inefficient investments (bonds, REITs) in tax-advantaged accounts

- Place tax-efficient investments (index funds, long-term stock holdings) in taxable accounts

Factor Investing

Consider incorporating evidence-based factors that have historically delivered premium returns:

- Value (undervalued companies)

- Size (smaller companies)

- Momentum (stocks with positive price trends)

- Quality (companies with strong fundamentals)

Dollar-Cost Averaging vs. Lump Sum

Research suggests that lump-sum investing typically outperforms dollar-cost averaging over the long term, but the latter may be psychologically easier during volatile markets.

When to Seek Professional Help

While many investors successfully manage their own balanced portfolios, consider professional guidance if:

- Your financial situation is complex

- You lack time or interest in portfolio management

- You struggle with emotional investment decisions

- Your portfolio has grown significantly in size

Options include:

- Robo-advisors (automated, algorithm-based management)

- Financial advisors (personalized guidance)

- Wealth management services (comprehensive financial planning)

Conclusion: The Path to Investment Success

Building and maintaining a balanced investment portfolio is one of the most important steps you can take toward financial security. By diversifying across asset classes, aligning investments with your personal goals and risk tolerance, and maintaining discipline through market cycles, you can create a resilient portfolio designed to weather various economic conditions.

Remember that successful investing is a marathon, not a sprint. Focus on the long-term picture, avoid reactive decisions based on market noise, and stay committed to your investment strategy.

Other Investors also Read about :

Risk Management for Long-Term Investors: Essential Strategies for Market Resilience