Introduction

In a world of low interest rates and rising inflation, deciding where to park your cash can be tough. Two common choices—money market funds and savings accounts—offer different paths depending on your goals, risk tolerance, and need for liquidity. This guide will walk you through the pros and cons of each, so you can make an informed decision and maximize your earnings without compromising your peace of mind.

📌 Key Questions:

✅ What’s the difference between money market funds and savings accounts?

✅ Which option offers higher returns and better liquidity?

✅ Are money market funds riskier than savings accounts?

🚀 In this guide, we’ll compare:

✔ How money market funds and savings accounts work

✔ Interest rates, liquidity, safety, and fees

✔ Which option is best for your short-term cash

Let’s dive into the details and find out which is the smarter choice for your money! 🔍💡

1. What Are Money Market Funds and Savings Accounts?

Both money market funds (MMFs) and savings accounts are used to park cash safely while earning some interest, but they function differently.

✅ A. What is a Savings Account?

✔ Offered by banks and credit unions.

✔ Pays fixed interest on deposits.

✔ Funds are FDIC-insured (up to $250,000 per account per bank).

✔ Best for emergency savings and easy access to funds.

💡 Example: A savings account at Chase or Wells Fargo earns interest while keeping your money safe.

✅ B. What is a Money Market Fund (MMF)?

✔ A type of low-risk mutual fund that invests in short-term debt securities (T-bills, commercial paper, CDs).

✔ Managed by investment firms (Vanguard, Fidelity, Charles Schwab).

✔ Not FDIC-insured, but regulated by the SEC.

✔ Often offers higher yields than savings accounts.

💡 Example: A money market fund at Vanguard (VMFXX) or Fidelity (SPAXX) invests in highly liquid short-term securities and earns daily interest.

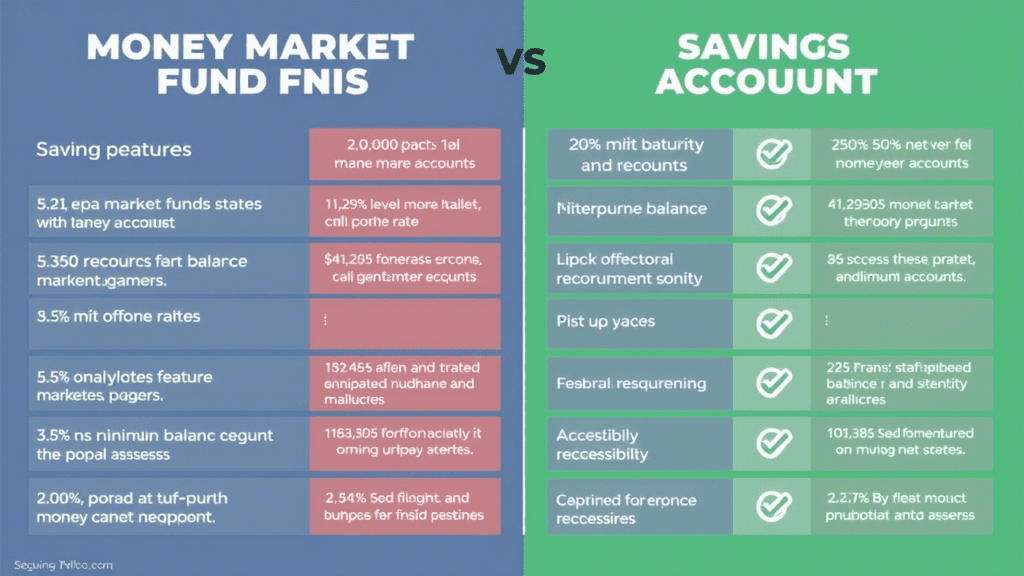

2. Comparing Savings Accounts vs. Money Market Funds

| Feature | Savings Account | Money Market Fund |

|---|---|---|

| Interest Rate (APY) | 0.5% – 4.5% | 4.5% – 5.5%+ |

| Safety & Risk | FDIC-insured (very safe) | Not FDIC-insured (but low risk) |

| Liquidity | Instant withdrawals | Withdrawals take 1-3 days |

| Minimum Balance | Often $0 – $100 | Usually $1,000 – $3,000 |

| Best For | Emergency savings, everyday cash | Parking cash for higher yields |

📌 Key Takeaway: Money market funds usually offer higher yields, but savings accounts provide FDIC protection and immediate access to cash.

3. Interest Rates: Which Option Pays More?

✅ A. Savings Accounts: Lower, but More Stable Returns

✔ Big banks offer low yields (~0.01% – 1%).

✔ High-yield savings accounts (HYSA) offer 3% – 4.5% at online banks (Ally, Marcus, SoFi).

💡 Example:

- Bank of America savings account: 0.01% APY (almost nothing).

- Ally Bank high-yield savings account: 4.35% APY (much better).

✅ B. Money Market Funds: Higher Yields, but Variable

✔ Money market funds currently yield 4.5% – 5.5%, higher than most savings accounts.

✔ Returns fluctuate based on interest rates.

💡 Example:

- Vanguard Federal Money Market Fund (VMFXX) – 5.3%

- Fidelity Government Money Market Fund (SPAXX) – 5.1%

📌 Winner: Money Market Funds—better interest rates, especially when the Federal Reserve raises rates.

4. Liquidity & Accessibility: How Quickly Can You Access Your Cash?

✅ A. Savings Accounts: Instant Access

✔ Withdraw cash anytime from ATMs, branches, or online transfers.

✔ Ideal for emergencies and everyday transactions.

💡 Example: Need $500 for an emergency? Withdraw instantly from a savings account.

✅ B. Money Market Funds: Takes 1-3 Days

✔ Withdrawals take 1–3 business days to reach your bank account.

✔ Not ideal for immediate emergency cash needs.

💡 Example: If you need cash urgently, a money market fund isn’t as convenient as a savings account.

📌 Winner: Savings Accounts—easier and faster access to your cash.

5. Safety & Risk: Is Your Money Protected?

✅ A. Savings Accounts: FDIC-Insured (Very Safe)

✔ Deposits are insured up to $250,000 per bank per account.

✔ Zero risk of losing money (unless the bank fails and exceeds FDIC limits).

💡 Example: Even if Chase Bank fails, FDIC covers up to $250K of your deposits.

✅ B. Money Market Funds: Not FDIC-Insured, But Still Low Risk

✔ Invests in government-backed securities (T-bills, corporate bonds, CDs).

✔ No FDIC protection, but rarely loses value.

✔ Regulated by the SEC for safety.

💡 Example: In rare cases, a money market fund could “break the buck” (drop below $1 per share), but this is very unlikely for government-backed funds.

📌 Winner: Savings Accounts—FDIC protection makes them 100% risk-free.

6. Fees & Minimum Balance Requirements

✅ A. Savings Accounts: Usually No Minimum Balance

✔ Most banks have no minimum balance, but some charge fees if your balance is low.

💡 Example: Bank of America charges $8–$12/month unless you maintain a $500 balance.

✅ B. Money Market Funds: May Require a Higher Minimum Investment

✔ Some funds require $1,000 – $3,000 to start investing.

✔ No monthly fees, but expense ratios (0.10% – 0.30%) reduce returns slightly.

💡 Example:

- Vanguard VMFXX: Minimum $3,000 investment.

- Fidelity SPAXX: No minimum investment.

📌 Winner: Savings Accounts—easier to open with lower minimums.

7. Which One Should You Choose? 🤔

📌 Choose a Savings Account If:

✔ You need instant access to your money.

✔ You want FDIC protection (zero risk).

✔ You have less than $1,000 to deposit.

📌 Choose a Money Market Fund If:

✔ You want higher returns (~5% APY).

✔ You don’t need immediate access to cash.

✔ You’re comfortable with small interest rate fluctuations.

Final Verdict: Which is Better?

📌 For emergency funds & everyday cash → Savings Accounts ✅

📌 For higher returns & short-term investing → Money Market Funds ✅

🚀 Key Takeaways:

✔ Money market funds offer higher interest rates (4.5% – 5.5%) than most savings accounts.

✔ Savings accounts are safer (FDIC-insured) and more accessible for emergencies.

✔ If you don’t need instant withdrawals, a money market fund is the better choice for extra cash.

🚀 Follow us for more personal finance and investing tips! 💰