Taxes are one of the biggest expenses you’ll face in your lifetime—but with the right approach, you can legally reduce your tax burden and grow your savings. Many people overpay taxes simply because they don’t take full advantage of deductions, credits, and tax-efficient investment strategies.

By optimizing your tax strategy, you can:

✅ Keep more of your income instead of giving it to the IRS.

✅ Lower your taxable income and reduce your overall tax bill.

✅ Grow long-term wealth with tax-efficient investments.

✅ Leverage tax-free growth for retirement and education savings.

This guide covers top tax-saving strategies for individuals, business owners, and investors—helping you minimize your tax liability in 2025 and beyond.

📌 1. Maximize Tax-Advantaged Retirement Accounts

Retirement accounts offer some of the best tax breaks while helping you build long-term wealth.

A. Traditional vs. Roth Retirement Accounts

✔ Traditional 401(k) & IRA – Contributions are tax-deductible, but withdrawals are taxed in retirement.

✔ Roth 401(k) & Roth IRA – Contributions are made with after-tax dollars, but withdrawals are 100% tax-free in retirement.

📌 Smart Strategy:

If you expect to be in a lower tax bracket in retirement, go with a Traditional IRA/401(k) for upfront tax savings.

If you expect to be in a higher tax bracket in retirement, choose a Roth IRA/401(k) for tax-free withdrawals.

💡 Example:

Contributing $6,500 to a Traditional IRA in 2025 can reduce your taxable income by $6,500, potentially saving you $1,500+ in taxes (depending on your bracket).

B. Max Out Employer 401(k) Matching

✔ Many employers match 401(k) contributions—this is free money you shouldn’t leave behind!

✔ If your employer matches 100% up to 5% of your salary, contribute at least 5% to maximize your benefits.

📌 Example:

Earning $60,000 per year? Contributing 5% ($3,000) to your 401(k) means your employer also adds $3,000—doubling your retirement savings!

📈 2. Optimize Your Investment Tax Strategy

Investing wisely can reduce your tax burden and maximize long-term gains.

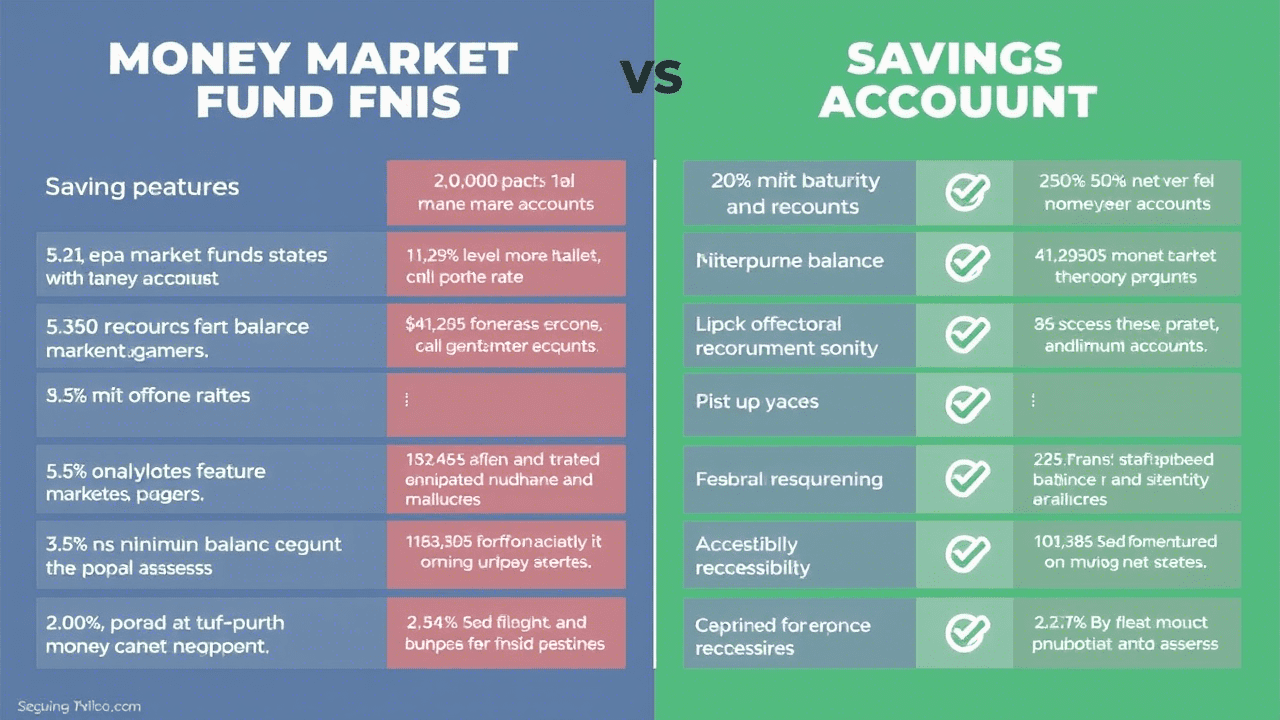

A. Use Tax-Advantaged Investment Accounts

✔ Health Savings Account (HSA) – Contributions are tax-deductible, grow tax-free, and withdrawals for medical expenses are tax-free.

✔ 529 College Savings Plan – Grow savings tax-free when used for education.

✔ Municipal Bonds – Earn tax-free interest at the federal level (and sometimes state level).

📌 Example:

Invest $10,000 in municipal bonds with a 4% yield, and you’ll earn $400 in tax-free income annually.

B. Utilize Tax-Loss Harvesting

✔ Sell losing investments to offset capital gains and lower your tax bill.

✔ If losses exceed gains, you can deduct up to $3,000 from your ordinary income.

💡 Example:

If you have $5,000 in stock gains but a $3,000 loss from another investment, your taxable gain is reduced to $2,000.

C. Hold Investments for Over a Year (Capital Gains Tax Savings)

✔ Short-term capital gains (assets held less than 1 year) are taxed as ordinary income (up to 37%).

✔ Long-term capital gains (held over a year) are taxed at 0%, 15%, or 20%—much lower!

📌 Example:

Selling a stock after 6 months? You might pay 35% in taxes (if in a high tax bracket).

Holding it for over a year? You only pay 15%—saving you thousands in taxes!

🏡 3. Maximize Tax Deductions & Credits

Deductions and credits reduce your taxable income or directly lower your tax bill.

A. Common Tax Deductions

✔ Mortgage Interest Deduction – Deduct interest on home loans up to $750,000.

✔ Student Loan Interest Deduction – Deduct up to $2,500 of interest paid.

✔ Charitable Contributions – Deduct donations to qualifying charities.

✔ Self-Employment Tax Deduction – Deduct 50% of Social Security & Medicare taxes if self-employed.

✔ Home Office Deduction – Deduct a portion of rent, utilities, and internet costs if you work from home.

📌 Example:

Donate $5,000 to charity, and you may reduce taxable income by $5,000, saving $1,250 in taxes (assuming a 25% tax rate).

B. Tax Credits (Dollar-for-Dollar Tax Savings!)

✔ Child Tax Credit: Up to $2,000 per child.

✔ Earned Income Tax Credit (EITC): Reduces taxes by up to $7,430 for low-to-moderate earners.

✔ Lifetime Learning Credit: Up to $2,000 per year for education expenses.

✔ EV Tax Credit: Up to $7,500 for purchasing an electric vehicle.

📌 Example:

Owe $3,000 in taxes? A $2,000 education credit brings your bill down to $1,000!

📊 4. Tax Optimization for Business Owners & Freelancers

Self-employed? These strategies can significantly reduce your tax liability.

A. Set Up a Tax-Advantaged Retirement Plan

✔ Solo 401(k): Contribute up to $66,000 (2025 limit) as both an employee and employer.

✔ SEP IRA: Contribute up to 25% of your income (maxing at $66,000).

📌 Example:

Freelancing and earning $100,000? A $25,000 SEP IRA contribution lowers your taxable income to $75,000.

B. Deduct Business Expenses

✔ Office Rent & Equipment – Laptops, desks, software = tax write-offs.

✔ Business Travel & Meals – Partially deductible when work-related.

✔ Marketing & Advertising – Website, social media ads, and branding expenses are deductible.

📌 Example:

Spend $10,000 on business expenses? Your taxable income drops by $10,000, saving $2,500 in taxes (assuming a 25% tax rate).

🔮 5. Strategic Tax Planning for the Future

A. Move to a Tax-Friendly State

✔ No State Income Tax: Texas, Florida, Nevada, Washington.

✔ Low-Tax States: Tennessee, Arizona, North Carolina.

📌 Example:

Moving from California (13.3% tax rate) to Florida (0% tax) could save a high-earner tens of thousands annually!

B. Estate & Inheritance Tax Strategies

✔ Set Up a Trust – Reduce estate taxes for your heirs.

✔ Gift Tax Exclusion – Give up to $18,000 per year (2025 limit) tax-free.

💡 Example:

Passing down $1M in assets through a trust can avoid major estate taxes!

🚀 Final Thoughts: Start Saving on Taxes Today!

✅ Maximize retirement contributions for tax-free growth.

✅ Use investment tax strategies like tax-loss harvesting.

✅ Claim all deductions and credits to lower your tax bill.

✅ Plan for business taxes if you’re self-employed.

✅ Consider moving to a low-tax state for extra savings.

📢 What’s your top tax-saving strategy for 2025? Let us know in the comments! 💬

🔥 Follow us for expert tax tips & wealth-building strategies! 🚀