When it comes to building wealth through investing, your mindset matters more than your math skills. While financial education is important, the harsh reality is that why most people fail at investing has little to do with lacking technical knowledge and everything to do with human psychology. Even investors who can calculate compound interest and understand market fundamentals often make costly emotional decisions that sabotage their long-term financial success.

The most successful investors aren’t necessarily the smartest—they’re the ones who master their emotions and develop disciplined behavioral patterns that withstand market volatility and psychological pressure.

Why Do Most People Fail at Investing?

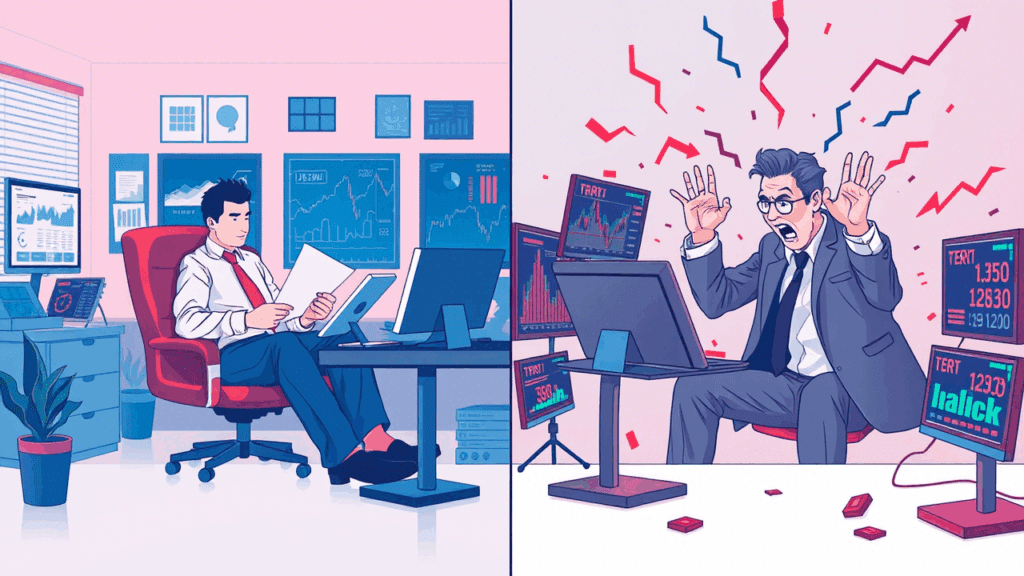

Most people fail at investing because they make emotional decisions based on fear and greed rather than sticking to a long-term strategy, leading them to buy high during market euphoria and sell low during downturns.

This behavioral pattern, driven by psychological biases rather than rational analysis, destroys wealth over time and prevents investors from benefiting from compound growth.

The Psychology of Money: Understanding Your Financial Mind

The psychology of money reveals that our relationship with investing is deeply rooted in emotions, cognitive biases, and subconscious beliefs formed early in life. Money triggers powerful psychological responses that can override logical thinking, especially during times of market stress.

Research in behavioral finance shows that investors consistently make predictable mistakes driven by evolutionary survival instincts that served our ancestors well but work against us in modern financial markets.

How Emotions Override Logic in Investment Decisions

Emotional investing manifests in several destructive ways:

- Fear-based selling: Panic-selling during market downturns locks in losses and prevents recovery

- Greed-driven speculation: Chasing hot stocks or trends leads to buying at peak prices

- Analysis paralysis: Overthinking decisions prevents taking action when opportunities arise

- Confirmation bias: Seeking information that confirms existing beliefs while ignoring contradictory evidence

Common Investing Mistakes That Destroy Wealth

Investment Behavior Mistakes Driven by Psychology

The most costly investment behavior mistakes stem from predictable psychological patterns:

1. Market Timing Attempts Most investors try to predict market movements, buying when markets feel “safe” (usually at peaks) and selling when fear dominates (typically at bottoms). This buy-high, sell-low pattern is the primary reason individual investors underperform market indices.

2. Overconfidence Bias Success in one investment often leads to overconfidence, causing investors to take excessive risks or make larger bets without proper diversification.

3. Loss Aversion The psychological pain of losing money is twice as powerful as the pleasure of gaining it, leading investors to hold losing positions too long while selling winners too early.

The Herd Mentality Problem

Behavioral finance insights reveal that humans are wired to follow the crowd, especially during times of uncertainty. This herd mentality creates:

- Bubble formation when everyone buys the same “hot” investments

- Panic selling when fear spreads through markets

- Missed opportunities when contrarian thinking would be most profitable

Why Investors Lose Money: The Psychology Behind Bad Investment Decisions

The Role of Cognitive Biases

Understanding the psychology behind bad investment decisions requires recognizing these common cognitive traps:

Recency Bias: Overweighting recent events when making decisions, assuming current trends will continue indefinitely.

Anchoring: Fixating on specific price points or past performance when evaluating investments.

Mental Accounting: Treating different money sources differently, such as being more reckless with “windfall” money than earned income.

Emotional Triggers That Lead to Poor Choices

Financial markets deliberately trigger emotional responses:

- FOMO (Fear of Missing Out): Drives speculative behavior and trend-chasing

- Loss aversion: Prevents cutting losses and taking necessary risks

- Overconfidence: Leads to insufficient diversification and excessive trading

How to Avoid Investment Failure: Practical Behavioral Finance Tips

Developing Emotional Intelligence for Investing

How to avoid investment failure starts with building self-awareness around your emotional triggers and psychological biases:

Create an Investment Policy Statement: Document your goals, risk tolerance, and decision-making criteria before emotions take over.

Implement Systematic Approaches: Use dollar-cost averaging and automatic rebalancing to remove emotional decision-making from routine investing.

Practice Mindful Investing: Before making any investment decision, pause and ask yourself: “Am I making this choice based on logic or emotion?”

Building Behavioral Safeguards

Successful behavioral finance tips include:

- Set up automatic systems that remove daily decision-making from your investment process

- Create accountability structures through financial advisors or investment clubs

- Establish cooling-off periods before making major portfolio changes

- Track your emotional state when making investment decisions

The Power of Long-Term Thinking

Why Time Horizon Matters More Than Timing

The most successful investors understand that time in the market beats timing the market. Historical data consistently shows that patient, disciplined investors who stay invested through market cycles outperform those who attempt to jump in and out of markets.

Compound Growth and Behavioral Consistency

Albert Einstein allegedly called compound interest the eighth wonder of the world. However, capturing compound growth requires behavioral consistency—the ability to keep investing regularly regardless of market conditions or emotional impulses.

Overcoming Psychological Barriers to Investment Success

The Importance of Financial Self-Awareness

Developing investment success requires honest self-reflection about your relationship with money. Many investors struggle because they’ve never examined their deep-seated beliefs about wealth, risk, and financial security.

Consider these questions:

- What money messages did you learn in childhood?

- How do you typically react to financial stress?

- What are your real motivations for investing?

Building Mental Resilience for Market Volatility

Mental preparation for market downturns is crucial. Successful investors develop coping mechanisms before they need them:

- Scenario planning: Mentally rehearse how you’ll respond to various market conditions

- Education: Understanding market history reduces fear during normal volatility

- Perspective: Remember that temporary fluctuations are normal parts of long-term wealth building

Professional Help: When to Seek Behavioral Coaching

Sometimes overcoming psychological barriers requires professional assistance. Consider behavioral coaching or financial therapy if you:

- Consistently make emotional investment decisions despite knowing better

- Experience significant anxiety around money and investing

- Have repeated patterns of investment self-sabotage

- Struggle with spending or saving behaviors that undermine investment goals

Creating Your Personal Investment Psychology Plan

Practical Steps for Implementation

- Assessment Phase: Identify your specific psychological triggers and biases

- System Design: Create automated processes that minimize emotional decision-making

- Monitoring Setup: Establish regular check-ins to review both performance and behavior

- Continuous Learning: Commit to ongoing education about both markets and psychology

The Role of Investment Journaling

Keeping a detailed investment journal helps identify patterns in your decision-making. Record not just what you bought or sold, but why you made each decision and how you felt at the time. This creates invaluable data for improving future choices.

Conclusion: Mastering Your Money Psychology for Investment Success

The path to investment success isn’t found in complex financial formulas or market predictions—it’s discovered by understanding and managing your own psychology. While technical knowledge matters, your ability to make rational decisions under pressure, stick to long-term plans, and learn from mistakes will ultimately determine your financial future.

The investors who build lasting wealth aren’t those who never make mistakes, but those who recognize their psychological patterns and create systems to work with their human nature rather than against it.

Ready to transform your investment approach? Start by honestly assessing your current behavioral patterns and implementing one systematic change this week. Consider keeping an investment decision journal or setting up automated investment contributions to remove emotion from your wealth-building process. Remember, the best investment strategy is the one you can stick with consistently, regardless of what the market throws at you.