Forget the beige suits. Finance is changing, fast. We’re diving headfirst into the sectors buzzing right now – from AI disrupting everything to green money getting serious. Are you ready to ride the wave or get crushed?

Welcome to the Financial Thunderdome: Where Money Gets Made or Lost

Let’s cut the crap. The finance world isn’t just skyscrapers and spreadsheets anymore. It’s a beast evolving at breakneck speed, driven by tech, global shifts, and raw ambition. If you’re still trading like it’s 2008, you’re already toast. This month, certain corners of the market aren’t just trending; they’re screaming for attention. These are the battlegrounds where fortunes will be forged or vaporized. Are you in?

Sector 1: AI & Machine Learning in Finance – The Silicon Overlords Are Here

Artificial intelligence isn’t just changing tech; it’s eating finance alive. We’re not talking about chatbots (though they’re there). We’re talking about algorithms trading faster than humans can blink, fraud detection systems smarter than any detective, and personalized financial advice that knows you better than your mom.

Why It’s Hotter Than a Volcano:

- Speed & Efficiency: AI algorithms execute trades in milliseconds, analyze market data at warp speed, and automate mundane tasks, freeing up human capital for higher-level strategy (or golf).

- Predictive Power: While not a crystal ball, AI can spot patterns and correlations in data that humans would never see, potentially offering an edge in forecasting market movements or identifying credit risks.

- Personalization at Scale: Robo-advisors and AI-powered platforms are making tailored financial services accessible to the masses, disrupting traditional wealth management.

The Flip Side: Watch Out for the Robots

This isn’t a guaranteed win. Algorithmic trading failures can cause flash crashes. Bias in training data can lead to discriminatory lending. And frankly, the ‘black box’ nature of complex AI can be terrifyingly opaque. Understanding the risks isn’t just smart; it’s survival.

Keep an eye on companies specializing in AI-driven trading platforms, risk assessment tools, and automated compliance solutions. The winners here will define the next decade of finance.

Sector 2: FinTech’s Relentless March – The Banks Are Scrambling

FinTech isn’t new, but its impact is intensifying. It’s the disruptor tearing down the old guard, offering sleeker, cheaper, and faster ways to handle money. From digital wallets and neobanks to blockchain payments and fractional investing, FinTech is making finance more accessible and, frankly, cooler.

The Pulse Check on FinTech:

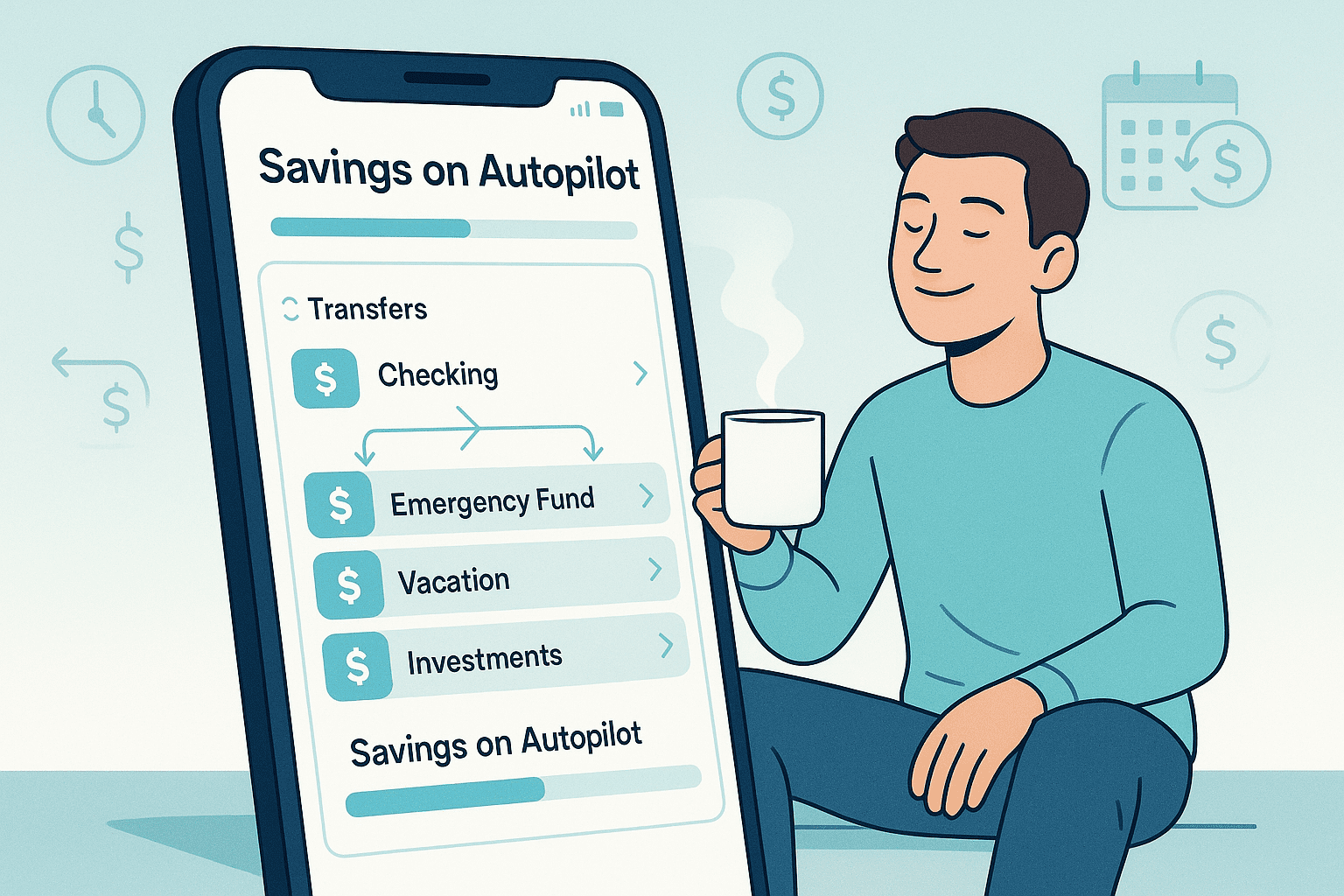

- Payments Reimagined: Contactless payments, peer-to-peer transfers, and cross-border transactions are becoming seamless and instantaneous.

- Banking Without Branches: Neobanks are challenging traditional institutions with lower fees, better user experience, and mobile-first approaches.

- Democratizing Investing: Platforms offering fractional shares, commission-free trading, and easy access to alternative assets are pulling in new generations of investors.

The Pitfalls: Not All Shiny Apps Are Gold

Regulation is still playing catch-up. Data security is a constant battleground. And competition is brutal – everyone wants a piece of the pie. Plus, the underlying profitability of some models is still questionable. It’s innovation fueled by venture capital, and that well can run dry.

Look for FinTech firms solving real-world problems, not just building trendy apps. The ones integrating deeply with existing infrastructure or creating entirely new, sticky ecosystems are the ones to bet on.

Sector 3: Sustainable Finance & ESG Investing – Doing Good While Making Bank?

Once a niche, ESG (Environmental, Social, Governance) is now front and center. Investors are demanding that their money aligns with their values, pushing companies to clean up their act. This isn’t just about saving the planet; it’s about identifying companies built for the future, resilient to climate risks, social unrest, and governance failures.

Why It’s More Than Just a Fad:

- Regulatory Push: Governments and central banks worldwide are increasingly focused on climate risk and sustainability reporting, making ESG integration a compliance necessity, not an option.

- Investor Demand: Millennials and Gen Z are pouring money into sustainable funds. Major institutions are integrating ESG factors into their investment decisions. The demand signal is loud and clear.

- Risk Mitigation: Companies with strong ESG performance are often better managed, more innovative, and less exposed to regulatory fines, supply chain disruptions, or reputational damage.

The Reality Check: Greenwashing is Real

The biggest danger here is ‘greenwashing’ – companies or funds pretending to be sustainable without genuine substance. Data can be inconsistent or manipulated. Defining and measuring ‘impact’ is complex and often subjective. You need to look beyond the marketing hype.

Focus on sectors enabling the transition to a lower-carbon economy (renewable energy, clean tech) or companies with genuinely transparent and robust ESG frameworks. Demand real data, not just feel-good stories.

Sector 4: Private Credit – The New Banking Underworld?

With traditional banks pulling back on lending, especially to mid-sized companies, private credit funds have stepped into the void. These funds provide direct loans to businesses, offering higher yields than traditional bonds but with less liquidity and often more risk. It’s finance’s wild west, and money managers are piling in.

The Allure of Private Credit:

- Higher Yields: In a low-interest-rate environment (which might be changing, but the principle holds), private credit offers attractive returns compared to public fixed income.

- Floating Rates: Many private credit deals have floating interest rates, offering a hedge against rising rates.

- Direct Relationship: Funds work directly with borrowers, allowing for tailored deals and potentially more control in distressed situations.

The Brutal Truth: It’s Not for the Faint of Heart

Liquidity is almost non-existent – once you’re in, you’re in. Transparency can be low compared to public markets. Due diligence is paramount, and the potential for losses is significant if the borrower defaults. This is sophisticated stuff, not a retail play (usually).

Unless you’re an institutional investor or a high-net-worth individual with access, this is a sector to watch from the sidelines to understand where capital is flowing and the health of private companies. But for those with the capital and risk appetite, it’s a massive opportunity.

Don’t Just Watch – Position Yourself

These sectors aren’t just abstract concepts; they represent fundamental shifts in how money works. Whether you’re an investor, a finance professional, or just trying to understand where the world is heading, ignoring these trends is financial suicide.

Do your homework. Kick the tires. Understand the tech, the regulations, the real risks. Fortune favors the bold, but it absolutely crucifies the ignorant. Get informed, stay sharp, and maybe, just maybe, you’ll capture some of that explosive growth.

The Bottom Line

Finance is messy, thrilling, and constantly changing. AI, FinTech, ESG, and Private Credit are demanding attention right now. They offer immense potential, but also the risk of getting burned. Your move.

Ready to navigate the future of finance? Explore our latest insights and analysis. Contact us for a consultation.